Mortgage lenders look at your credit scores and financial history to decide whether they feel you’re a good candidate for a home loan. By getting a pre-approval, you can start shopping around for home you like that fit within your budget. While a pre-approval isn’t a guaranteed loan if your financial situation changes, it is enough to make a bid on homes you like and begin the process. Moreover, unless you have enough resources in your bank account to make a purchase outright, most real estate agents and home sellers require a pre-approval before selling.

To obtain a mortgage pre-approval, there are several things you need. Planning to buy a home is not a spur-of-the-moment decision, and you will not be moving in next week or even next month. It’s wise to start about six months in advance and clear up any existing credit issues so your scores can be as high as possible before you seek a pre-approval. A mortgage pre-approval checklist will help you determine what to collect and what steps to take.

What Is a Mortgage Pre Approval Checklist?

A mortgage pre-approval checklist helps you get ready to apply for mortgage pre-approval. You need mortgage pre-approval to bid on homes in most cases. Getting educated about this process and using an organized checklist can help raise your chances of doing things right the first time. Additionally, it will help lower your stress and answer some basic questions you may have about how mortgage pre-approvals work and what you need to get one.

The Ultimate Mortgage Preapproval Checklist

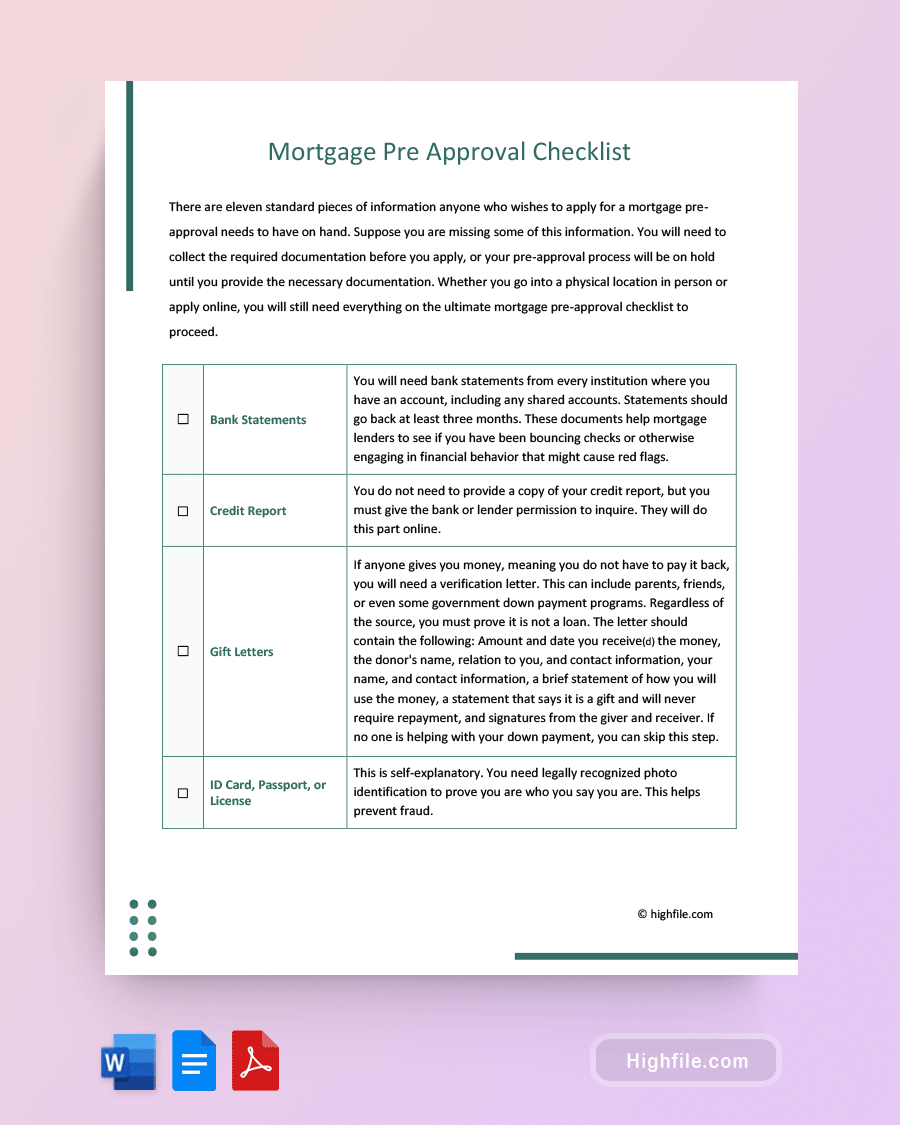

There are eleven standard pieces of information anyone who wishes to apply for a mortgage pre-approval needs to have on hand. Suppose you are missing some of this information. You will need to collect the required documentation before you apply, or your pre-approval process will be on hold until you provide the necessary documentation. Whether you go into a physical location in person or apply online, you will still need everything on the ultimate mortgage pre-approval checklist to proceed.

- Bank Statements- You will need bank statements from every institution where you have an account, including any shared accounts. Statements should go back at least three months. These documents help mortgage lenders to see if you have been bouncing checks or otherwise engaging in financial behavior that might cause red flags.

- Credit Report- You do not need to provide a copy of your credit report, but you must give the bank or lender permission to inquire. They will do this part online.

- Gift Letters- If anyone gives you money, meaning you do not have to pay it back, you will need a verification letter. This can include parents or friends or even some government downpayment programs. Regardless of the source, you must prove it’s not a loan. The letter should contain the following: Amount and date you receive(d) the money, the donor’s name, relation to you, and contact information, your name, and contact information, a brief statement of how you will use the money, a statement that says it is a gift and will never require repayment, and signatures from the giver and receiver. If no one is helping with your downpayment, you can skip this step.

- ID Card, Passport, or License- This is self-explanatory. You need legally recognized photo identification to prove you are who you say you are. This helps prevent fraud.

- Investment Account Statements- Lenders need to know your assets, including stocks, bonds, 401(k), 403(b), and IRAs. While you cannot simply spend this money, it is part of your financial profile. Again, if you don’t possess these assets, you can leave out this information, but you must include them to apply if you have them.

- Landlord References- If you are a renter, you must include the names and contact information for all the places you have lived for the last 5-7 years. For those who live at home or otherwise don’t pay rent, you may still need to submit information regarding your housing and who owns the property where you reside.

- Monthly Debts List- Your Debt-to-Income ratio or DTI helps a lender decide whether you are creditworthy and capable of repayment. They will ask for a list of your Fixed Debts. These include anything you repay regularly that has a minimum payment amount. Examples of fixed debt include the following: Credit Cards, Car Loans, Home Insurance or HOA fees, Rent or Mortgages, Medical Bills, and other loans like Student Loans and Personal Loans.

- Pay Stubs & W-2s- It is not sufficient to say you have a job. You have to prove you are employed with pay stubs. Both physical checks and direct deposits can be printed and submitted. If you are paid in cash, you may need to ask how they would like the verification, such as a letter from your employer to go with your bank statements. You’ll also need your W2 forms from the last two years.

- Rental Information- Renters will need to provide a copy of their lease or rental agreement to prove they live where they say they do. This also helps prevent fraud.

- Social Security Card- Again, this is self-explanatory. You need a social security card to apply for a mortgage pre-approval because it helps verify your identity.

- Tax Documents- They will ask you to provide two years’ worth of back tax documents to help verify your income and any deductions.

If You Already Own a Home

Whether you are looking to buy a second home, investment property, or move and sell your previous home, you will need to provide mortgage and tax documents regarding your current property. This information goes toward determining your DTI and creditworthiness because it is part of your monthly debts. Even if you are working on selling a home, you still have to turn in this paperwork if you still own the property. Likewise, if you own more than one property, you will need to submit information on all of them.

If You’re Self-Employed

Self-employed people provide their proof of income in different ways. Although it’s not often required, you can include a copy of your business licenses. Meanwhile, freelancers may need copies of their W4s or other contracts and 1-3 years’ worth of business tax returns. Finally, you also need to provide a year-to-date audited Profit and Loss statement, or year-to-date unaudited Profit and Loss Statement, and the last 60 days’ worth of business bank statements. You need to show a stable, reliable income stream to be considered for mortgage pre-approval.

For Nonconventional Loans

Nonconventional loans include USDA and FHA loans, among others. While these typically require all the above documentation, they can also have additional requirements.

VA Loans

VA loans work differently, but the additional paperwork you need is relatively straightforward. You will have to provide the following documents to prove you qualify. If you no longer have copies of your paperwork, you can get them in person from the National Archives- National Personnel Record Center (NPRC) or submit a request to the National Personnel Records Center website here (https://www.archives.gov/personnel-records-center).

- DD 214- This form shows a veteran’s military discharge, separation or retirement information. Active duty military members will not yet have this form and can skip this step.

- NGB 23 or Retirement Points Statement- An NGB 23 shows your years of service. Again, this document only applies to previous military service, and you may not need to submit it if you are still on active duty.

- Statement of Service- Your Statement of Service form shows your current active duty or reserve status.

Please Note: The VA Home Loan program was started in 1944 as part of the GI Bill of Rights or Servicemen’s Readjustment Act. Military spouses and children cannot apply for VA loans. Only active service members, reserves, and retired or former military can get this loan. However, some military widows can still apply. According to Military.com (https://www.military.com/money/va-loans/va-loan-eligibility-expands-for-surviving-spouses.html#:~:text), “Surviving military spouses may be eligible for a VA home loan if they have not remarried and: Their spouse died in the service or from a service-related disability. Their spouse was missing in action (MIA) or a prisoner of war (POW) for at least 90 days (limited to the one-time use of benefit), or their spouse was rated continuously totally disabled for the specified period and was eligible for disability compensation at the time of death by any cause.”

FAQs

Below we’ve answered a few common questions about your mortgage pre-approval checklist. The information here can help you understand and increase your mortgage pre-approval odds. Once you’ve been through the process the first time, refinancing later or buying a second home will be easier if you decide to move in the future.

Not only can you get preapproved by multiple lenders, but it’s also often a smart choice. By making several inquiries, you can find out who offers the best rates out of the available options. You are essentially pitting the lenders against each other to compete for your business.

You should never lie to a mortgage lender, but there are also things you shouldn’t say. For example, foolish statements, like ‘I am thinking about switching jobs’ or ‘I just got all new credit cards,’ will look bad. In general, stick to providing the information they ask for and don’t overshare or ask money questions. Save your financial questions for an advisor who isn’t approving a loan. Your mortgage lender needs to feel confident in your ability to make payments on time. They should never hear about your plans to buy a new car or how you just consolidated a bunch of credit card debt.

You can be denied a mortgage after being pre-approved. Fortunately, that only happens when there are significant changes to your financial situation. For example, you may be refused if you take out large loans or lose your job.

You can wait until the day before you start shopping around for a home to get pre-approved for a mortgage—however, pre-approvals only last three months. If you need more time to find the right house after that, you must ask for a pre-approval. As for how far in advance you should get pre-approved for a mortgage, it’s a good idea to start shopping as soon as possible to find the right house, so three months before you want to close on a home is an excellent time to start.

Applying for a mortgage will cause a slight temporary dip in your credit because it triggers a hard inquiry. In short, yes, applying for a mortgage will hurt your credit. However, in the long run, a mortgage approval will help increase your credit, and hard inquiries drop off your record after about two years.

Final Thoughts

Getting a mortgage pre-approval should be an exciting experience because it means you are looking to buy a home. However, it’s essential to go into the situation armed with the proper information to sound competent, provide the necessary data, and have a higher chance of getting what you’re asking for. Shop around for the best deal, and be prepared to lose a few points from your credit score temporarily. It’s also vital to make sure your financial status doesn’t change while you’re house hunting. If you clear up any credit issues and can show that you are reliable and capable of repayment, you should have no trouble getting a pre-approval right away.