There are a lot of ways to use a credit card these days. You can swipe it, tap it, or input digits manually. However, some businesses still offer a Credit Card Authorization Form option. These unique documents allow the business to create a specific written record of permission for a transaction. The customer fills out the document and signs it to show they agree to be charged, which minimizes disputes and other issues. Read on, and we’ll explain all about how Credit Card Authorization Forms work.

What Is a Credit Card Authorization Form?

A Credit Card Authorization Form lets businesses and merchants securely obtain a customer’s permission to charge their credit card for specific goods or services. The form itself is specific written consent from the cardholder, granting the business or merchant the authority to process the payment. It includes essential details like the cardholder’s information, credit card details, transaction amount, description of goods or services, and an authorization date. By using this form, businesses ensure compliance with payment processing regulations, protect themselves from chargeback disputes, and create a transparent and legally sound payment process that helps build customer confidence.

Why is a Credit Card Authorization Form Necessary?

A Credit Card Authorization Form is necessary for businesses and merchants to streamline their payment processes. It can ensure smooth, secure transactions, protects both parties involved in the transaction, and establishes clear terms and conditions. Here is why you need this document:

- Legal Compliance: Using a Credit Card Authorization Form helps businesses adhere to payment card industry regulations and guidelines.

- Consent Documentation: It is written proof that the cardholder has authorized the specific payment. Recording this minimizes the risk of chargeback disputes.

- Transaction Transparency: It shows a clear breakdown of the goods or services purchased and the transaction amount.

- Payment Security: Collecting credit card information directly from the cardholder means businesses can better ensure the security of sensitive financial data.

- Reduced Payment Delays: Obtaining authorization in advance reduces delays in processing payments and delivering goods or services.

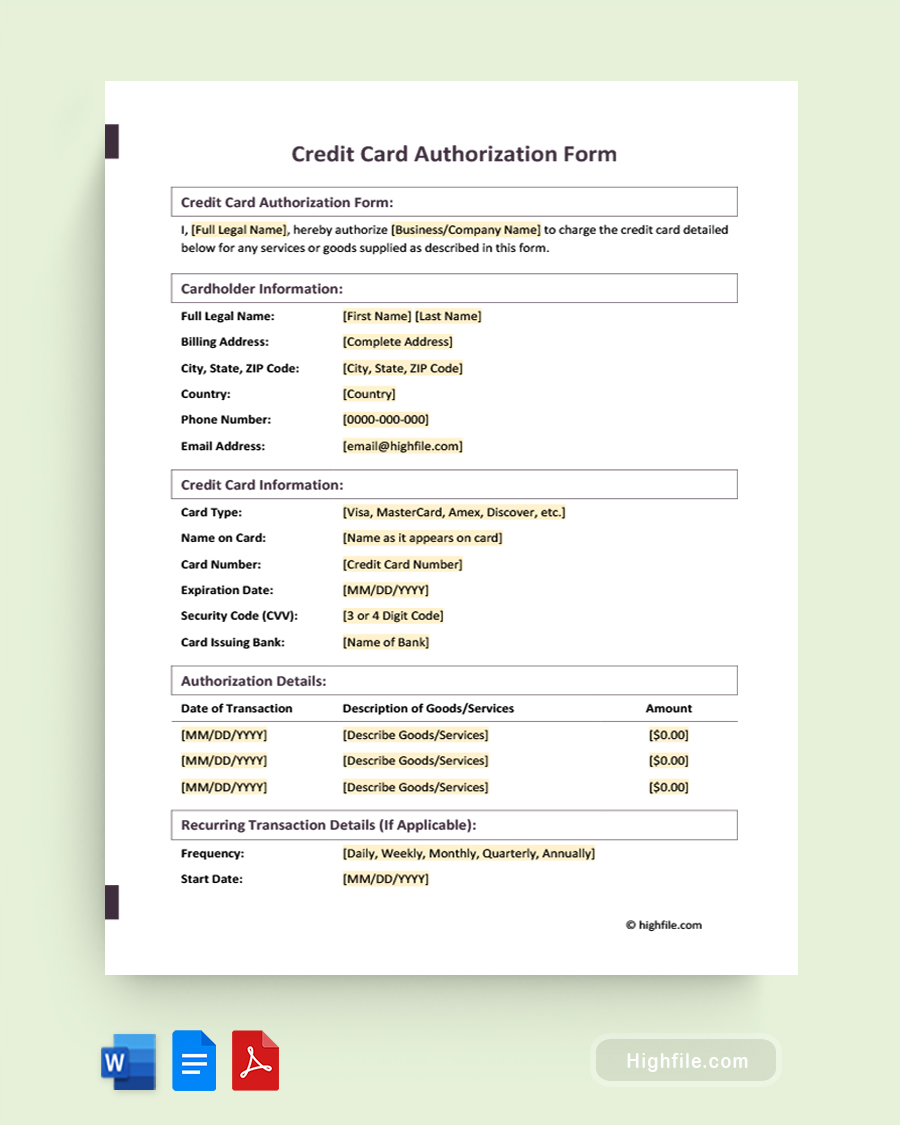

Essential Elements of Credit Card Authorization Form

The essential elements of a comprehensive Credit Card Authorization Form help ensure clarity and legal validity. The different sections generally aid in obtaining and recording the necessary information for payment processing, like customer identity, card information, and clear authorization. We’ve put together an outline to explain this form in more detail so you understand how it works.

- Form Title: This identifies the document as a Credit Card Authorization Form using a large, bold print at the top of the form to avoid confusion.

- Intent Statement: The first section states the form’s purpose. It says that the cardholder authorizes the specified transaction.

- Cardholder Information: Next, you need to record the cardholder’s full name, billing address, contact details, and any other relevant identification information.

- Credit Card Information: Here, customers add the credit card number, expiration date, CVV (Card Verification Value), and other relevant details.

- Authorization Details: This records the date of the transaction, a description of the goods or services being purchased, and the exact amount to be charged.

- Recurring Transaction Details: If applicable, this area specifies recurring transactions and their frequency, allowing for continuous billing.

- Terms and Conditions: The terms and conditions outline the authorization agreements and parties’ responsibilities. It has details such as refund policies, cancellation procedures, and any additional fees.

- Signature: A Credit Card Authorization Form needs the cardholder’s signature to confirm the provided information and authorization.

- For Office Use Only: At the bottom, there is generally a space for internal use. The merchant can record details such as the person verifying the form and the verification date.

FAQ

Businesses and merchants that accept credit card payments for goods or services should use a Credit Card Authorization Form. It is particularly useful for transactions where the customer is not physically present or when processing recurring payments. Here are a few examples of who uses these vital documents:

Online Businesses: E-commerce websites and online service providers may need Credit Card Authorization Forms to process payments securely.

Service Providers: Businesses like subscription-based models, freelancers, and consultants can utilize this document for recurring payments.

Travel and Hospitality Industry: Hotels, travel agencies, and tour operators use this form to secure bookings and process payments for remote customers.

Mail and Phone Orders: Businesses that take credit card payments through mail or phone orders use the Credit Card Authorization Form to obtain authorization.

Subscription-Based Services: Companies with subscription-based services or memberships use it for recurring billing.

A properly executed Credit Card Authorization Form is considered a legally binding document. When the cardholder signs and authorizes the specified transaction, they explicitly consent to the payment. This form is written proof of this authorization.

A Credit Card Authorization Form can be used for recurring payments, like subscriptions or ongoing service charges. The form can include a section for recurring transaction details. This convenient feature helps streamline the payment process and ensures continuous service without requiring repeated authorizations for each transaction.

Numerous specific regulations or legal requirements exist for using a Credit Card Authorization Form. Here are some examples:

PCI DSS Compliance: The Payment Card Industry Data Security Standard specifically safeguards sensitive credit card data.

Consumer Protection Laws: Businesses must comply with all relevant consumer protection laws and regulations, providing transparent terms and conditions in the form. It’s important to note that these can vary based not only on where you are but where your business is licensed and registered and where your customers sign it.

Data Privacy Regulations: Data privacy laws often require the secure storage and handling of customer information. This means limiting access to only a few authorized individuals, keeping physical copies in secure locations and locked cabinets, and behind a password or two-factor authentication.

Card Network Rules: Following the rules and guidelines set by card networks (e.g., Visa, Mastercard) is also crucial to avoid potential penalties.

Electronic Signatures: Finally, when the form is signed electronically, it should adhere to electronic signature regulations in the relevant jurisdiction.

The Credit Card Authorization Form is a comprehensive document that collects the necessary information from the cardholder to authorize a specific transaction or recurring transaction. Meanwhile, a credit card charge authorization is a brief communication initiated by the merchant or business to the card issuer. The charge authorization is a more concise and direct request for payment approval and does not typically include the same level of detail as the form. However, both are legal documents used to collect payment authorization.

Final Thoughts

A Credit Card Authorization Form is a crucial document that facilitates secure and legally binding credit card transactions. Businesses use this form for recurring payments, streamlining payment processes, and ensuring uninterrupted services for customers. By getting proper written consent from the cardholder, businesses can process payments confidently and transparently. This form must have essential elements like cardholder identification, credit card details, authorization details, and terms and conditions. This ensures a comprehensive and compliant form. Many industries benefit from using this form every day, including online businesses, service providers, and subscription-based services. When using a Credit Card Authorization Form, it is vital to adhere to all relevant regulations, such as PCI DSS compliance and consumer protection laws, to uphold the form’s legal validity and avoid potential problems. Our Credit Card Authorization Form can help you save time and ensure your document has all the proper fields for customers to fill out.