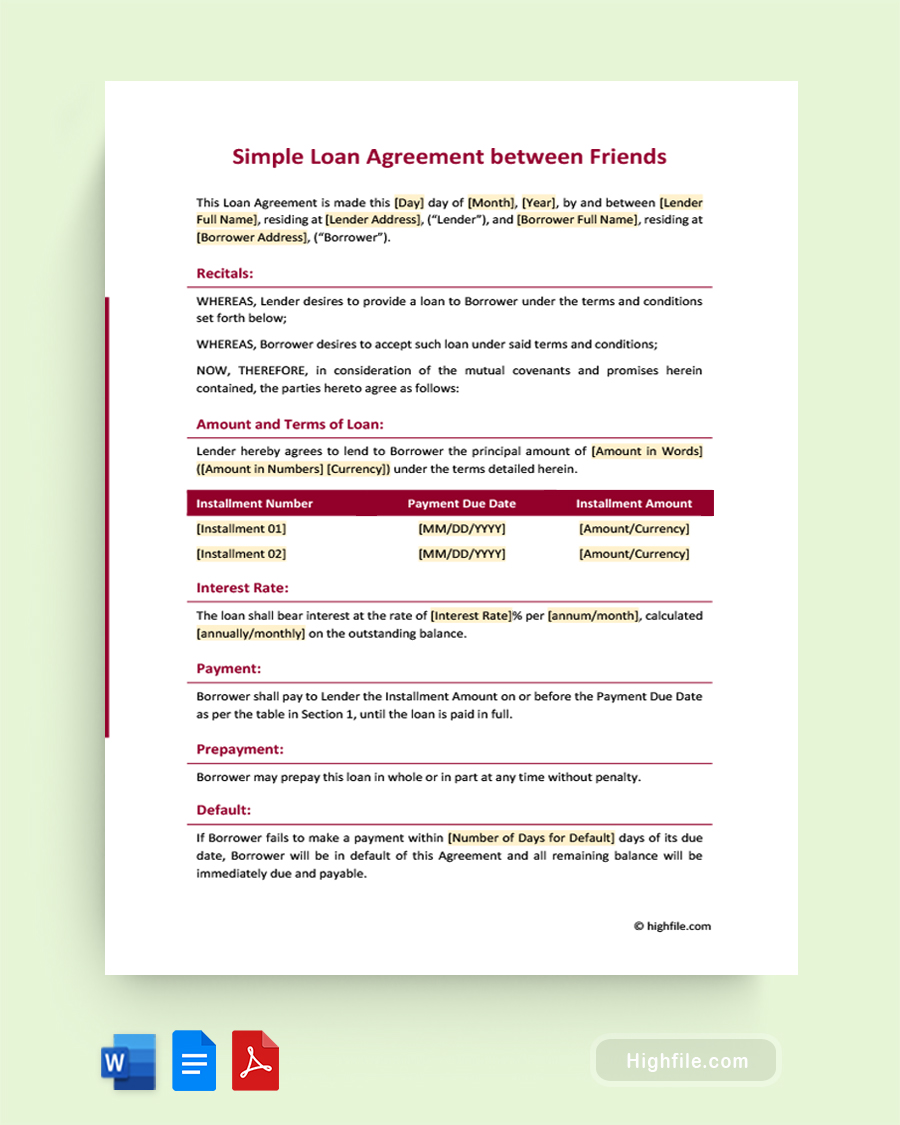

Contents of the Template

- Amount and Terms of Loan: Clearly states the principal loan amount and the detailed repayment schedule.

- Interest Rate: Specifies the rate of interest and how it is calculated.

- Payment Conditions: Sets the timeline and conditions for the borrower to make payments.

- Default and Late Charge Provisions: Outlines the consequences of missed or late payments and the associated fees.

- Security/Collateral (if applicable): Describes any collateral that is securing the loan, if applicable.

- Legal and Compliance Clauses: Includes clauses on governing law, notices, waiver of rights, and assignment to make the agreement legally robust.

- Signatory Section: Places for both the lender and borrower, and a witness if required, to sign and date the agreement.

Why Use This Template

- Clarity and Transparency: This template ensures both parties are on the same page regarding the loan amount, repayment schedule, and terms.

- Protects Relationships: Having a formal agreement can help prevent misunderstandings that could potentially harm a friendship.

- Customizable: Easily adaptable to suit your specific needs, the template is available in Word, PDF, and Google Docs formats for easy editing.

- Legal Safeguard: Although not a substitute for legal advice, this template provides a basic framework that can be reviewed by a legal professional.

Ideal For

- Loans Between Friends or Family Members: When a friend or family member is lending money, and both parties desire clear terms and a written record.

- Personal Loans Not Involving Financial Institutions: For situations where individuals are directly lending to each other rather than going through a bank.

- Short-Term or Small Loans: Particularly useful for less complex lending situations, where the parties trust each other but still want to document the terms.