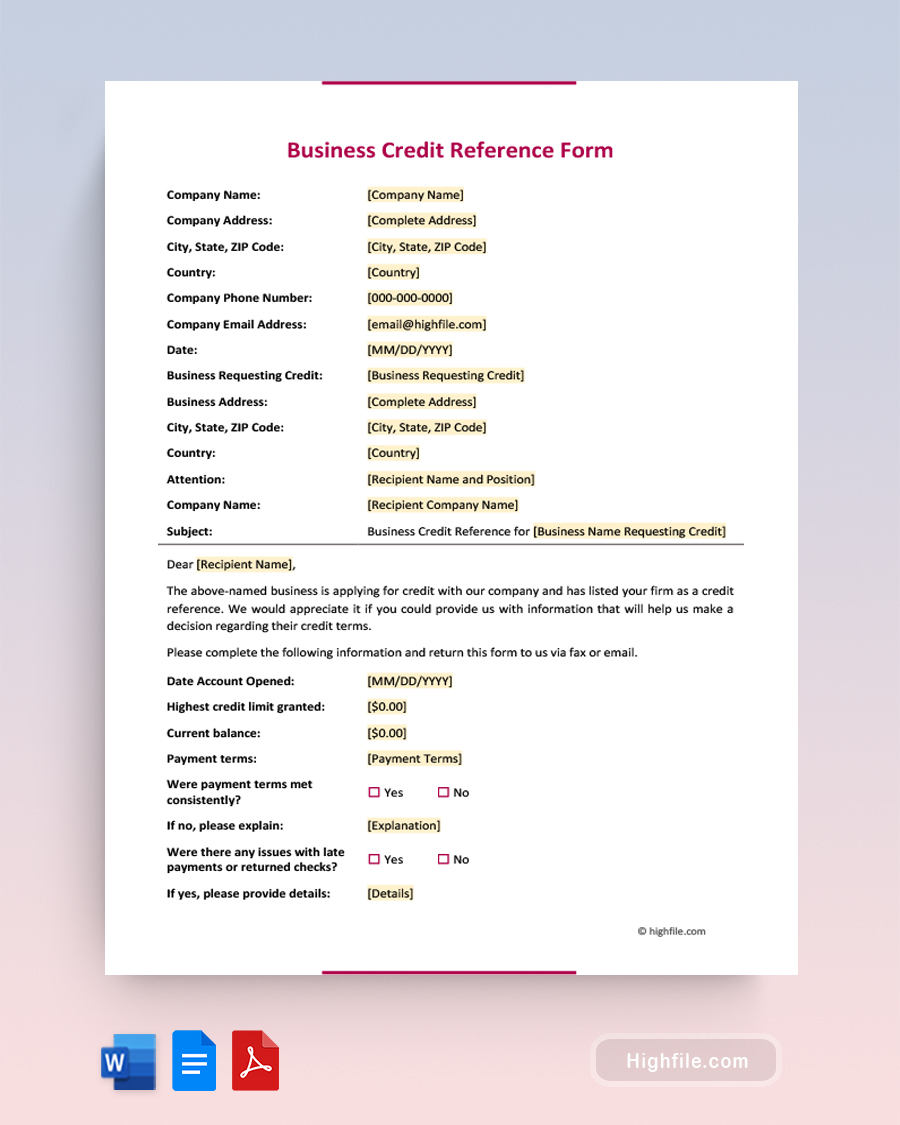

Contents of the Template:

- Company Details: This includes specific placeholders for your company name, address, telephone number, and email which aids in clear communication and ensures the recipient knows exactly who is making the request.

- Recipient Information: An organized space to detail the business and individual the credit reference is being sought from, ensuring a personalized and direct approach.

- Subject Line: Clearly indicates the purpose of the letter, ensuring immediate recognition of its intent.

- Detailed Questionnaire: A structured list of queries that are aimed at gathering a comprehensive understanding of the credit history of the business in question. This aids in making informed credit decisions.

- Confidentiality Assurance: A clause ensuring that the information will remain confidential, promoting trust and a higher likelihood of a response.

- Closing and Signature: Space for personal signing and the addition of a company seal or stamp for an added layer of authenticity.

Why Use This Template:

- Saves Time: Pre-defined placeholders and a structured format mean a quicker turnaround when seeking credit references.

- Enhanced Clarity: Its structured layout ensures that all vital information is included, minimizing the potential for confusion or missed details.

- Professional Appearance: The template follows a formal and professional format, enhancing the credibility of the requester.

- Encourages Response: The provision for confidentiality and a structured questionnaire may increase the likelihood of receiving a timely and comprehensive response.

Ideal For:

- Businesses Extending Credit: Any business that offers credit terms to another business can use this template to verify the creditworthiness of the potential creditor.

- Credit Departments in Organizations: This is ideal for teams or individuals responsible for assessing the financial risk of doing business with a new partner or client.

- Financial Institutions: Banks or lending institutions can use this format to gauge the creditworthiness of businesses seeking loans or other financial products.

- Supply Chain Management: For suppliers looking to extend credit terms to retailers or distributors, this provides a structured way to assess risk.

- Startups & SMEs: New businesses or SMEs entering into partnerships or looking for business loans can use this template to streamline their credit verification process.