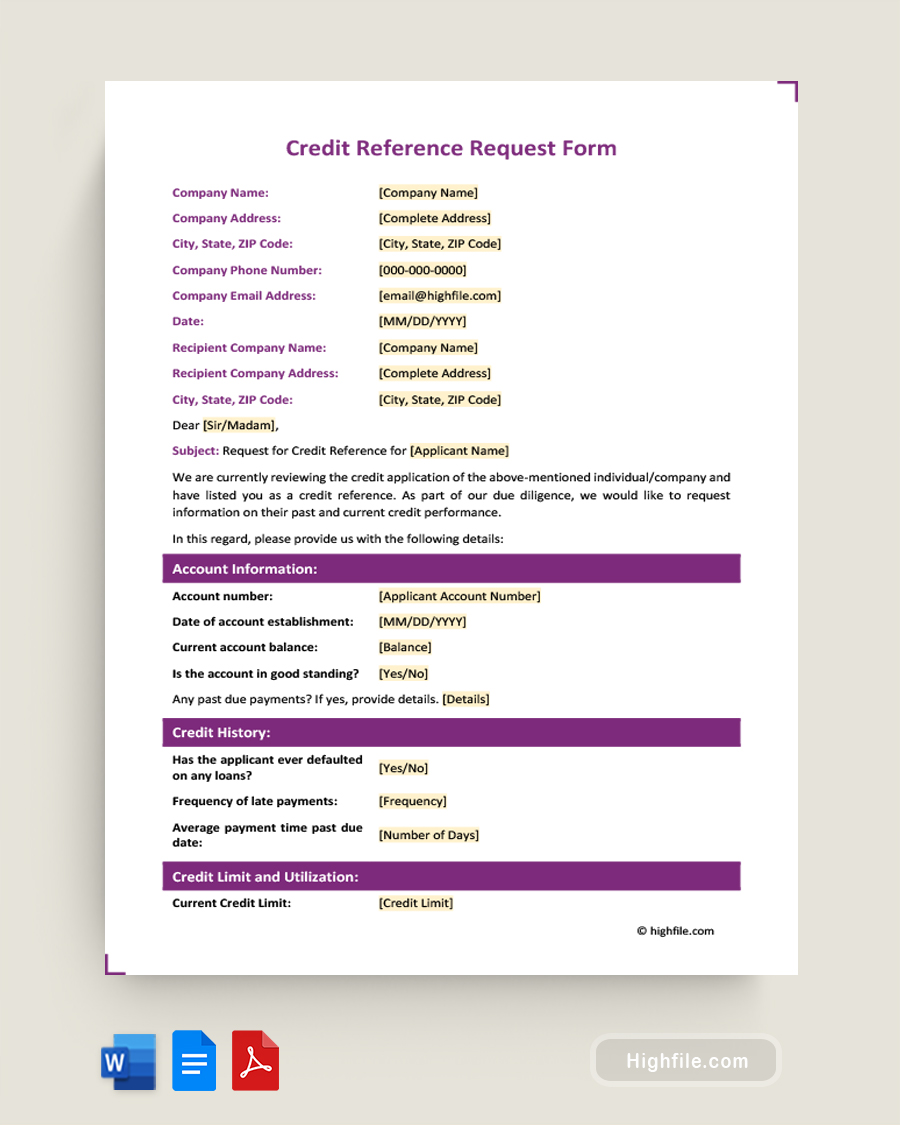

Contents of the Template:

- Personal and Business Information: A section designed to capture all the relevant details of both the requester and the individual or business being inquired about.

- Credit History Inquiry: Specific fields to capture past credit behaviors, any defaults, late payments, and other pertinent financial data.

- Account Details: Space to note down essential account information such as account number, establishment date, balances, and more.

- Feedback Section: A segment for the reference to provide any additional comments or observations about the credit behavior of the individual or company.

Why Use This Template:

- Streamlined Process: With clearly defined sections, it ensures all essential information is captured, making the credit reference process more efficient.

- Professional Design: Lends a professional appearance to your inquiry, increasing the likelihood of prompt and detailed responses.

- Adaptable for Various Needs: While comprehensive, it’s also flexible enough to cater to specific requirements, should there be any unique credit reference details you need.

Ideal For:

- Financial Institutions: Banks, credit unions, and other lending entities looking to vet potential borrowers.

- Business Transactions: Businesses checking the creditworthiness of another business before entering into contracts or partnerships.

- Landlords: Renting or leasing properties and wanting to check the financial reliability of potential tenants.

- Service Providers: Those offering post-paid services and wanting to ensure the client’s credit reliability.