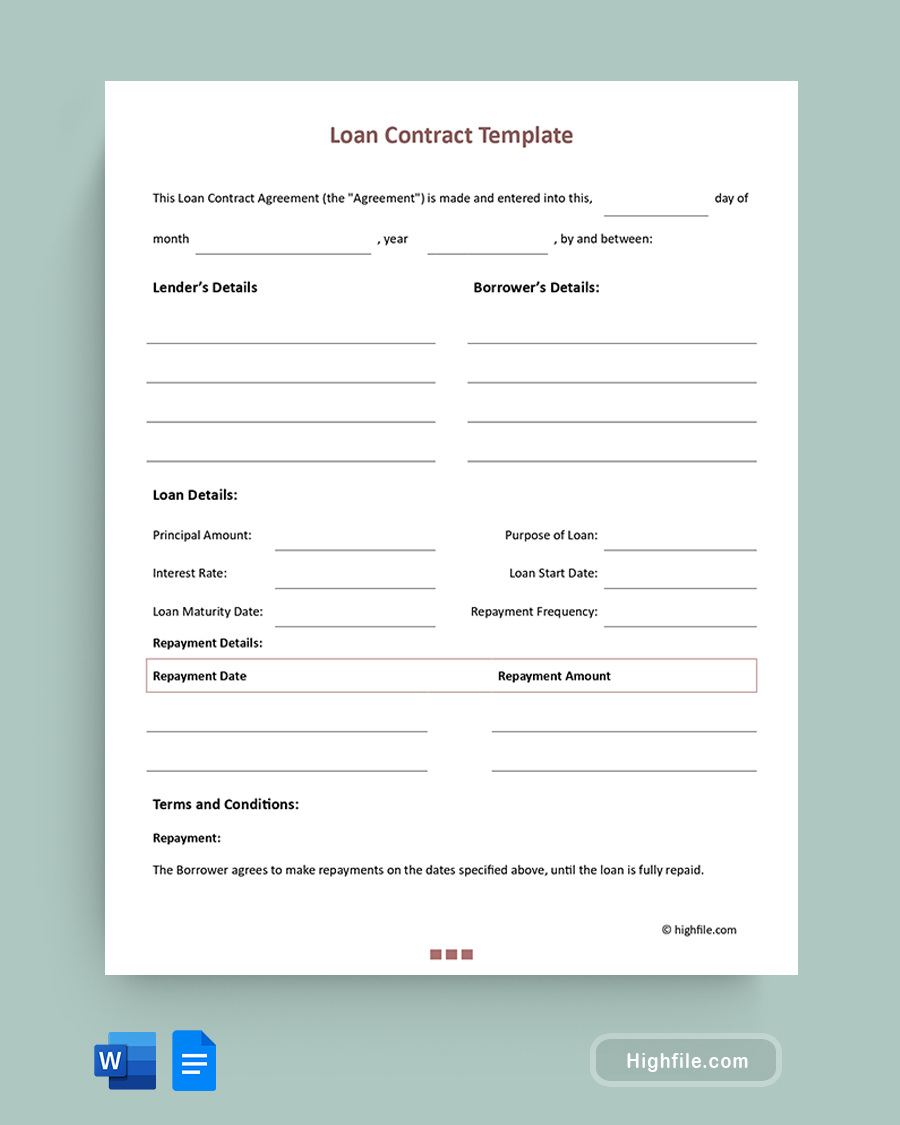

Contents of the Template:

- Principal and Interest Details: Clearly defines the amount borrowed and the interest rate applied.

- Borrower and Lender Information: Comprehensive fields for names, addresses, and other contact details.

- Loan Period: Specifies the start and end date of the loan.

- Repayment Schedule: Detailed table illustrating payment dates and amounts.

- Terms and Conditions: Outlines the rules and guidelines governing the loan agreement.

- Signatory Section: Dedicated space for both parties to affirm and sign the agreement.

Why Use This Template:

- Clarity and Consistency: Using a predefined format ensures that all necessary details are covered.

- Avoids Misunderstandings: Clearly stated terms reduce the possibility of disputes or disagreements.

- Saves Time: Instead of drafting from scratch, this template streamlines the process.

- Flexibility: Adaptable for various loan scenarios, with fields that can be customized as needed.

Ideal For:

- Personal Loans: Whether lending to friends or family, this template provides a formal structure.

- Business Loans: For small enterprises or startups seeking capital.

- Secured and Unsecured Loans: Can be adapted to specify if collateral is involved.

- Short-Term and Long-Term Loans: Suitable for varied loan durations, be it a few months or several years.