property ownership between involved parties. This form becomes particularly useful in cases where parties share a close relationship or when full title guarantees are not the main focus, such as transfers between family members or trusted friends. However, there are limitations, notably the absence of warranties, which may expose them to potential risks related to using this deed type. So utmost care and diligence are essential when handling property transactions in this manner. Read on, and we’ll help demystify this complex topic and teach you about these vital documents so you know if it is the right solution for you.

What Is a Quitclaim Deed Form?

A Quitclaim Deed Form is a legal document used in real estate transactions to transfer the ownership of a property from one party (the grantor) to another (the grantee). The quitclaim deed is especially useful when the parties involved have a pre-existing relationship and want a transfer without the complexities of title guarantees. Unlike a warranty deed, a quitclaim deed does not provide guarantees or warranties regarding the property’s title. Instead, it conveys the grantor’s interest in the property to the grantee. This type of deed is commonly used for transfers between family members, in divorce situations, or to clarify ownership issues.

Why Is Quitclaim Deed Form Important?

The Quitclaim Deed Form is important in facilitating the transfer of property ownership. Here are some of the reasons you might choose this document:

- Simplified Transfer Process: The Quitclaim Deed Form provides a straightforward and uncomplicated method for transferring property ownership. It bypasses the complexities and strict requirements associated with warranty deeds.

- Speedy and Cost-Effective: The preparation and execution of a Quitclaim Deed Form are relatively quick and cost-effective. This document allows for swift transfer process completion, saving time and expenses for all parties involved.

- Resolution of Ownership Disputes: The Quitclaim Deed Form can clarify ownership disputes or uncertainties by explicitly transferring any interest the grantor may have in the property to the grantee.

- Privacy and Confidentiality: Quitclaim deeds do not require the inclusion of a purchase price or other financial considerations, so they provide a level of privacy and confidentiality in the transaction.

- Intra-Family Transfers: Quitclaim deeds are frequently used for transfers between family members or related parties. For example, parents may transfer property to their children, or spouses may transfer ownership rights during divorce proceedings. In such cases, the quitclaim deed streamlines the process, fostering smoother family transactions.

- Clarifying Boundaries: The quitclaim deed helps delineate property boundaries and mitigate potential conflicts.

- Secondary Interest Transfers: In situations where the grantor has a secondary interest in the property, such as a partial or reversionary interest, a quitclaim deed can transfer that specific interest to another party.

- Establishing Joint Ownership: Quitclaim deeds are commonly utilized to add or remove joint owners on a property title.

- Preparation for Further Transactions: Quitclaim deeds can be a stepping stone for subsequent real estate transactions. For instance, they are sometimes used to clear a cloud on the title before proceeding with a full sale or mortgage transaction.

Essential Elements of Quitclaim Deed Form

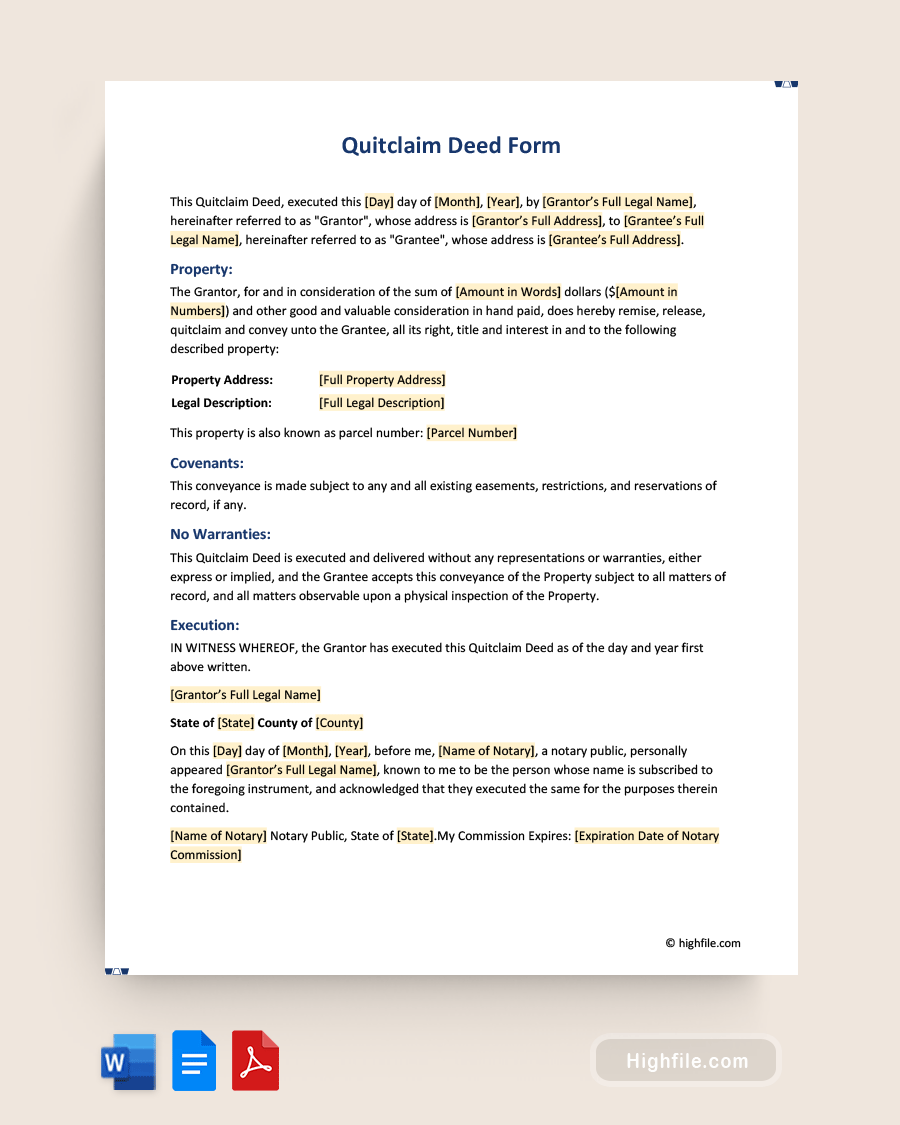

The essential elements of a quitclaim deed identify a property and clearly state that one party is giving up their interest in said property. Here is what you should see on a professionally designed template for this form:

- Form Title: Identifies the document ensuring clarity about its purpose and legal effect

- Intent Statement: States the grantor’s intention to transfer their interest in the property to the grantee

- Property Consideration Statement: Specifies the consideration exchanged for the property

- Property Description Chart: Provides detailed information about the property, like its address, and legal description, to precisely identify the parcel

- Parcel Number: Lists the unique identifier assigned to the property for taxation and recording purposes

- Covenants: States any agreements and often says that the grantor makes no warranties or guarantees regarding the property’s title, implying that the grantee accepts the property “as is”

- No Warranties: Reiterates the lack of warranties, emphasizing that the grantee receives the property without any assurances from the grantor

- Execution: The signatures of the grantor and any required witnesses solidifying the legal validity of the transfer

- Notary: Provides a notary section for notarizing the grantor’s signature if desired

- Acceptance by Grantee: Confirms the grantee’s acceptance of the property conveyed in the deed

- Notarization of Grantee’s Signature: Allows for the notarization of the grantee’s signature, if necessary.

- Preparation Statement: States who prepared the quitclaim deed to establish accountability for its contents

- Return To: Indicates where the completed deed should be returned after recording, typically to the grantee or their representative

FAQ

The notarization of a Quitclaim Deed Form is not always necessary. It depends on the jurisdiction’s regulations and the specific circumstances of the transaction. Some states mandate notarization to ensure the authenticity of the grantor’s signature and protect against fraud, but even in states where notarization is not required, parties may choose to have the deed notarized voluntarily to add an extra layer of validity and credibility to the document.

A Quitclaim Deed Form can be used to transfer both residential and commercial properties. The type of property does not affect the use of this form. A quitclaim deed can effectively transfer the grantor’s interest to the grantee regardless of property type. However, parties involved in commercial property transfers must consult with legal professionals and conduct thorough due diligence to address any potential complexities related to the transaction.

Here are the potential risks associated with a quitclaim deed form:

No Title Guarantees: Unlike a warranty deed, a quitclaim deed offers no guarantees or assurances regarding the property’s title, which means it’s not necessarily free from other claimants. The grantee may receive the property with undiscovered title issues.

Unresolved Liens: If the property has outstanding liens or debts attached to it, the grantee becomes responsible for settling those claims.

Inheritance and Tax Implications: In some cases, transferring property through a quitclaim deed may have inheritance or gift tax implications.

Lack of Ownership Validation: A quitclaim deed does not verify the grantor’s ownership interest.

Complex Ownership Scenarios: When multiple parties have interests in the property, like joint tenants or tenants in common, using a quitclaim deed may not fully clarify the ownership.

Lack of Legal Protections: The grantee may have limited legal recourse if issues arise after the transfer.

While a Quitclaim Deed Form can transfer a grantor’s interest in a property, it does not resolve existing title issues or disputes. A thorough title search and examination are necessary to address title issues or disputes.

Final Thoughts

A Quitclaim Deed Form is a valuable legal document that facilitates the transfer of property ownership between parties, especially when a pre-existing relationship or full title guarantees are not a primary concern. However, parties should be cautious about its limitations, particularly the lack of warranties and the potential risks of using this type of deed. Consulting with real estate professionals and legal experts is advisable to ensure that the transaction is conducted with due diligence for a smooth and secure transfer of property rights. Once you’re sure this is the correct path for you, our Quitclaim Deed Form Template will save you time and effort by providing the necessary format and wording to help you write your quitclaim easily.