Buying a new house or property can be incredibly exciting. However, there’s a lot to it, like mortgages and paperwork. One of the most common documents you’ll come across in this process is the warranty deed. In fact, if you plan to have a mortgage, your lender might require it. What is a warranty deed? How do you make one? What is it used for? We’ll explain all these things and more, plus provide you with an excellent, customizable template to work from.

What Is a Warranty Deed Form?

A Warranty Deed Form is a legal document used in real estate transactions to transfer property ownership from the seller (grantor) to the buyer (grantee). Unlike a quitclaim deed, a warranty deed provides substantial assurances to the grantee. This document guarantees that the title to the property is clear, free from defects, and legally valid. Essentially, the grantor promises that they have the legal right to transfer the property and that no undisclosed claims or encumbrances exist. This type of deed is widely regarded as one of the most secure ways to transfer property because it offers significant protection to the buyer.

Why Is Warranty Deed Form Important?

The Warranty Deed Form is important in real estate transactions because it is a fundamental legal document for transferring property ownership. It provides crucial assurances and protections to both the seller (grantor) and the buyer (grantee), ensuring a secure and transparent transfer process.

- Title Assurance: One of the primary reasons why the Warranty Deed Form is crucial is that it offers explicit guarantees from the grantor that the property’s title is clear, valid, and free from any undisclosed defects or encumbrances.

- Legal Validity: The Warranty Deed Form is a legally binding document establishing a contractual relationship between the grantor and grantee. Once executed and properly notarized, it becomes a valid and enforceable agreement, protecting the rights and interests of both parties involved.

- Confidence in Property Ownership: Sellers benefit when conveying property through this form. They instill confidence in potential buyers regarding the legitimacy and quality of the property’s title, making it an attractive option.

- Transparency and Clarity: The Warranty Deed Form records the property transfer, including specific covenants and details about the property. This level of transparency helps avoid misunderstandings or disputes.

- Lender and Mortgage Requirements: Many lenders and mortgage companies require warranty deeds as part of the closing process because the deed assures lenders that the property has a clear title.

- Preventing Future Disputes: By warranting the property’s title, the grantor takes responsibility for resolving any potential title disputes that may arise in the future. This proactive approach helps prevent costly legal battles for the grantee down the line.

- Flexibility for Ownership Arrangements: The warranty deed can accommodate various ownership arrangements, like joint tenancy or tenancy in common, allowing for seamless transfers of partial ownership interests.

- Recording and Public Notice: When properly executed and recorded, the warranty deed becomes a part of the public record, providing notice to third parties of the property’s ownership status.

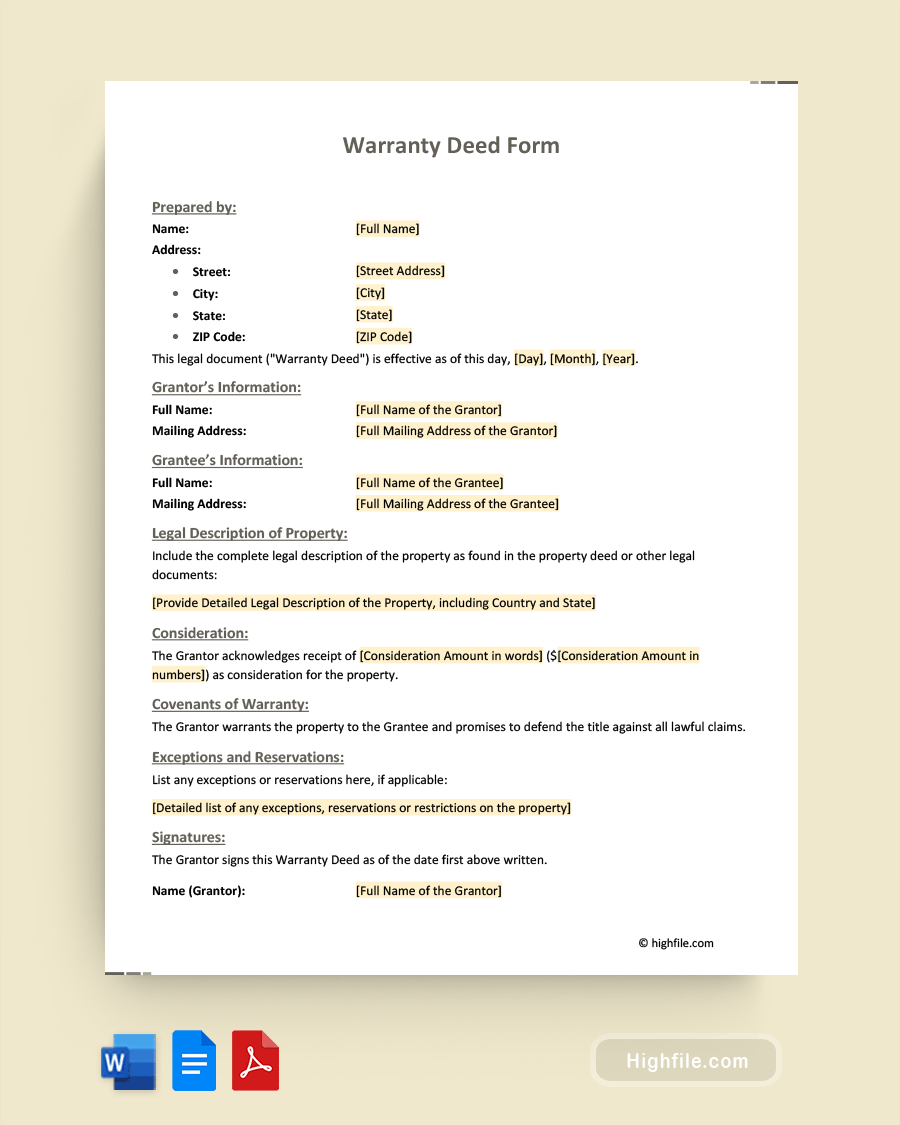

Essential Elements of a Warranty Deed Form

The essential elements of a warranty deed form cover all the vital aspects of the sale of a property. We’ve created a reference below, so you know each aspect and its intended use.

- Form Title: Identifies this as a warranty deed, distinguishing it from other types of deeds

- Prepared By: Adding the name of the individual or entity responsible for preparing the warranty deed ensures accountability for its accuracy and completeness.

- Effective Date: The date on which the warranty deed becomes legally effective, typically the date of execution

- Grantor Information: The full legal name and contact details of the party conveying the property, aka the seller or current owner.

- Grantee Information: The full legal name and contact details of the party receiving the property, aka the buyer or new owner.

- Legal Description of Property: A detailed and accurate description of the property, including metes and bounds, lot numbers, and other necessary details to identify the land being transferred

- Consideration: The value or consideration exchanged for the property. Usually, this means the purchase price.

- Covenants of Warranty: The specific warranties and promises made by the grantor

- Exceptions and Reservations: List of exclusions or reservations made by the grantor, detailing specific rights or interests they retain after the transfer

- Signatures: The signatures of both the grantor and grantee indicate their agreement to the terms of the deed. Additionally, it includes notary signatures and seals for notarization, authenticating the document’s validity.

- Instructions on Completion and Filing: Provides guidance on properly completing and filing the warranty deed, ensuring compliance with local recording requirements.

FAQ

legally binding property transfers. Here are some examples:

Sellers (Grantors): Use warranty deeds to transfer ownership rights to the buyer, promising that the property title is clear and free from undisclosed defects

Buyers (Grantees): Benefit from the protection offered by warranty deeds

Real Estate Agents and Brokers: Prepare or facilitate the completion of warranty deeds on behalf of their clients as part of the transaction

Title Companies: Verify title information and ensure that the warranty deed is properly recorded and executed

Lenders and Mortgage Companies: Often require warranty deeds as part of the closing process when issuing mortgages

A Warranty Deed Form is a legally binding document in real estate transactions. It establishes a contractual relationship between the grantor and grantee when executed properly, ensuring that the property’s title is transferred with the specified warranties and promises. Once signed and notarized, the warranty deed is a valid and enforceable agreement, providing the grantee with legal protections against potential title issues or defects.

A Warranty Deed Form can be used to transfer partial ownership interests in a property. This document can specify the percentage or portion of transferred ownership and any specific rights and responsibilities associated with the partial interest. This type of transfer allows for joint ownership arrangements, where each party holds a distinct share of the property. As with any property transfer, it is crucial to consult legal professionals and ensure that the deed accurately reflects the intended ownership structure.

Once a Warranty Deed Form is executed and delivered, it becomes a legally binding document, and its terms generally cannot be modified or revoked unilaterally. However, changes to the original deed’s terms can be made by mutual consent and agreement of both parties. This is done by creating a new deed reflecting the revised terms. There are also certain circumstances under which the deed may be invalidated or corrected, like in cases of fraud, forgery, or mistakes in the document. To ensure the proper execution and validity of a warranty deed, parties should seek legal advice.

Final Thoughts

In conclusion, the Warranty Deed Form is pivotal in real estate transactions. This document offers a secure, guaranteed means of transferring property ownership. Its importance lies in the extensive protection it offers sellers and buyers because of the specific warranties and promises accompanying the transfer of property title. This form fosters a high level of trust and confidence in the transaction process, assuring all parties that the property’s title is free from undisclosed defects or encumbrances. Seeking professional guidance and following the necessary steps and procedures makes the warranty deed an effective and legally binding instrument for a smooth and protected property transfer. Our Warranty Deed Form Template can help save you time and minimize errors when composing your document.