Getting a divorce is never a great situation. Some couples lose touch, others argue, running hot or cold. Meanwhile, some eventually decide that they simply made a wrong choice together, and it’s time to un-make the mistake. Making sound financial decisions is essential. There’s a lot of stress involved, even at the best of times. You’ll have to file the paperwork and tell everyone you know, but that’s only the beginning. If you are fortunate enough to divorce amicably, without lawyers and court time, you are still getting divorced.

Depending on your situation, deciding on the disposition of things you purchased together and making living arrangements is awkward, upsetting, infuriating, or a relief. If you have children or mutual pets, you and your soon-to-be former spouse also have to figure out where they’ll live. You don’t have complete control over shared decisions like those, but you can take charge of your personal finances. In fact, it’s critical to do so early in the process. The Ultimate Divorce Checklist below will take you through all the necessary steps and provide some insight into the process.

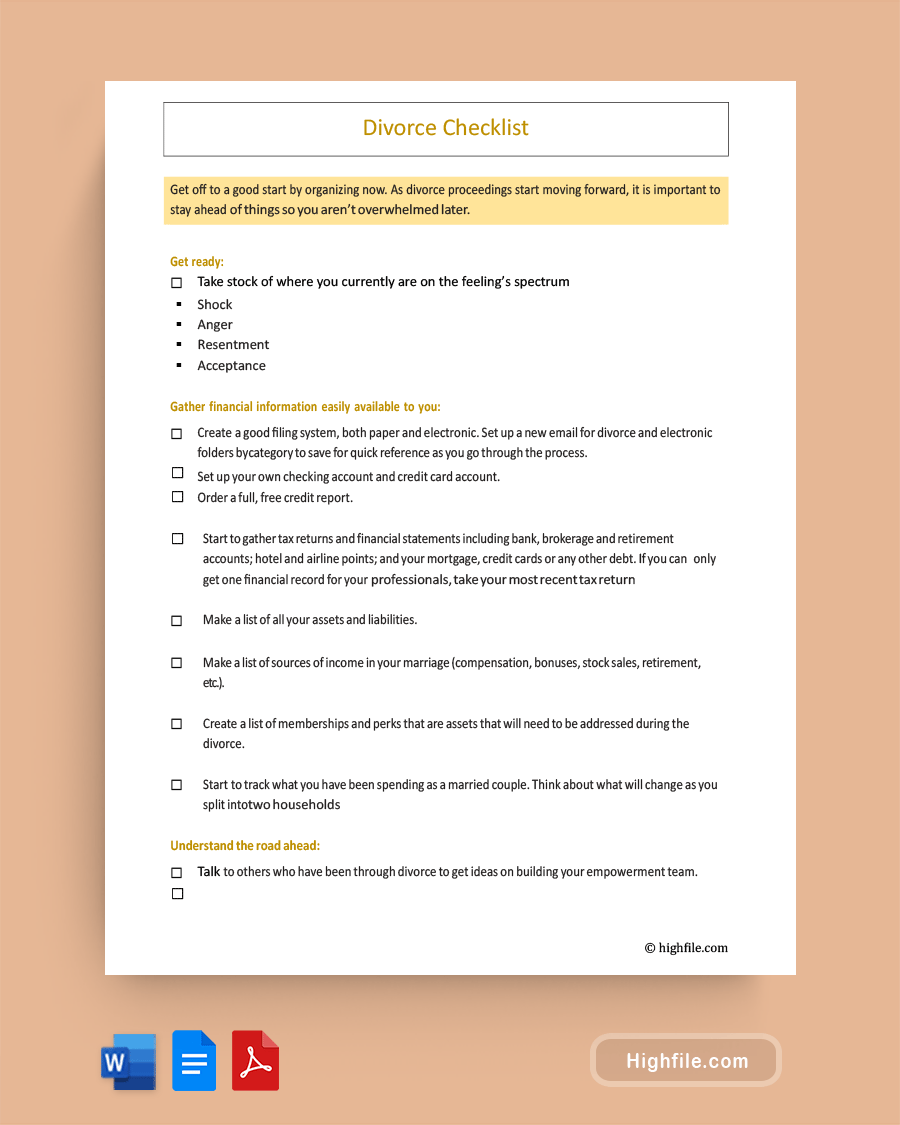

What Is a Divorce Checklist?

A divorce checklist will help you to get organized. Taking care of all the details, especially financial issues, can be taxing when going through the divorce process. Luckily, with a good checklist, you’ll have the tools you need to handle all the minutia of separating your life and money from your soon-to-be former spouse. Having the correct information and an actionable plan can make everything easier.

The Ultimate Divorce Checklist

The Ultimate Divorce Checklist below will help you break everything you need to do down into easy-to-manage pieces that you can go through systematically. You’ll be one step closer to your goal as you finish each item. Emotions can make this a tough time, but this tool helps take some pressure off you. Instead of trying to remember every little thing, simply check it off as you go.

New Accounts

One of the first things you should do when you are getting divorced is open new accounts in your name. If you already have accounts your spouse has no access to, you can skip this step, but make certain you use these moving forward instead of shared accounts. Even if your soon-to-be-ex is entirely trustworthy, and you are splitting up under excellent conditions, you need to get used to banking and managing money separately.

- Open a checking account in your name.

- Open a savings account in your name.

- If you share a joint investment account, you will also need one that is entirely yours.

- Open a credit card in your name.

Pro Tip: Talk to a financial advisor about what accounts you need and how best to use them. They may have some clever suggestions that help you stay more organized.

Assets and Liabilities

You need to know what your shared assets and liabilities are. This includes everything you own that has significant monetary value and everything you regularly pay or owe money for. Start by getting a free copy of your credit reports.

- Assess your shared resources. Bank accounts, investments, real estate, vehicles, jewelry, and other high-dollar valuables like antiques and furniture are all a part of this.

- Next, look at your shared liabilities. This side of the list needs to include everything from rent and car payments to your mortgage, utilities, debts, insurance cost, regular contributions to retirement funds, monthly memberships, and even small things like kids taking paid classes or pet insurance.

Pro Tip: Include everything on liabilities, even things you assume you won’t pay for because only your spouse uses them.

Self Protection

Everyone knows a story about how the ‘evil ex’ drained all the accounts or stole something important. Regardless of how you feel emotionally about your spouse, it would be best to protect yourself from possible interference. It doesn’t matter if your soon-to-be-former spouse is the best person on earth. You still need to take steps for common sense self-protection.

- Change all your passwords immediately. Even if you think your spouse doesn’t know them, change them anyway.

- Get a PO box down at the post office.

- Sign up for a credit monitoring service.

- Itemize your belongings, so you have a list of what is clearly yours. Leave off anything shared, or make a separate list.

- Consider getting a Safe Deposit Box at the local bank for your vital paperwork.

Pro Tip: If you have serious concerns, you can have your mail held at the post office and then change where it is sent, so you only get letters and packages delivered to your PO box. You can also get non-PO boxes for mail at many shipping stores, but remember to read the fine print since some shipping companies can’t receive mail on your behalf from the USPS.

Legal Documents

You are going to require many legal documents throughout this process. Your ID and Social Security Card are always necessary, but you’re going to need a file folder or manilla document envelope for the rest of the information. Make sure you make a second copy of everything and keep both in separate secure locations. You may want to give the copy to a trusted friend or family member.

- Business- If you own a business, there will be more paperwork here, such as LLC information and any info pertaining to business loans, payroll, insurance, and licensing. However, it would help if you also had divorce-relevant receipts and copies of any other payments you receive. If you have a trademark or patent, include it with the business paperwork.

- Taxes- You’ll need 5 to 7 years of back tax returns for the federal and state.

- Marriage Information- You may need your marriage license and any pre or post-nuptial agreements.

- Real Estate- If you own property, you’ll need deeds, any rental property records, mortgages, loans, appraisals, and the cost basis of your home.

- Medical and Wills- You should include your advanced healthcare medical directives, power of attorney, and last will and testament with your legal documents.

Pro Tip: You may want to put your legal and financial documents in separate folders for easier access.

Financial Paperwork

Financial paperwork is relatively straightforward. You will need copies of the documents establishing or governing all the items on the list below. You can get copies of this paperwork from your financial institutions and creditors even if your spouse has the originals/

- Checking and Savings Accounts

- Investment Accounts

- Credit Cards

- Loans

- Retirement

- Health Savings

- Insurance

Pro Tip: You can also print out credit card usage and transactions on your joint accounts. Doing this may be helpful if you need to see where your spouse is spending money and how much.

5 Things You Should Know About Divorce

- Divorce paperwork is relatively inexpensive, running from $200 to $500 in most cases. However, court costs will typically run over $1000 in a contested divorce. It is essential to budget for your divorce-related expenses.

- It generally takes 12 to 18 months to finalize a divorce.

- Lawyer fees for divorces average $7000 to $13,000. However, you can expect it to cost more if the case goes to court or the process is substantially delayed.

- Don’t promise anything, even verbally, unless you are sure it is in your best interests. Better still, talk to an attorney before you make agreements.

- Getting a therapist can help you through the complex emotional pieces of this process. If both partners are willing, you may even find that couples counseling can help you through the divorce and allow you to maintain a more civil relationship.

“You should only speak with your spouse if the communications are to be positive, essential, and pleasant. Feelings can run a little hot in divorce” “it happens, it’s natural,” “but you want to keep a level head. If you act threatening, harmful, or hateful, that will hurt you in divorce-court in matters such as child custody etc.”

Financial Mistakes to Avoid When Going Through a Divorce

We all make mistakes, but some are more costly. Below is a quick and easy list of people’s most common financial mistakes when going through a divorce. Consider these things to ensure a brighter future in your new post-divorce life.

- Start preparing your own accounts as soon as you know you’re getting a divorce, if possible, even before paperwork has begun. Having solo accounts in your name right away will help ease the transition.

- Don’t assume an even split is fair. Life is not as simple as cutting everything in half and taking one piece. A 50/50 division isn’t always the best way to go. It’s vital to pay attention to the value of assets and tax issues. Moreover, getting equal money value isn’t the same as having a fair split.

- Look at the whole picture. Instead of deciding everything as though each issue was separate, look at your entire financial picture and make choices based on how each part worked together.

- Remember how expensive going to court is. A typical divorce can cost over $12,000 in lawyer and court fees alone.

- Secure any support like alimony and child support with insurance. Taking this step will ensure that you are covered in the event that your ex is unable to work or they pass away.

- Never ‘take their word for it, where money is concerned. Always have your partner put agreements in writing. Doing this will prevent any confusion later.

- Look carefully at both partners’ financial responsibilities. Are there unsecured debts you might have to pay? Look at any defined benefit plans (DBP), 401ks with a Qualified Domestic Relations Order (QDRO), and your shared investments? You may need to get new insurance or speak to a financial advisor about how to separate your retirement funds.

- Don’t assume that the children, pets, and home should all go to one spouse. Even if you have more custodial time, it’s vital to consider whether you can afford the upkeep of your family home alone.

- Do an honest assessment of your financial ability and solvency. Skip anything you haven’t got yet, like alimony or returns on your investments. Knowing where you stand will help you plan better for the future.

Final Thoughts

Divorce requires compromise. Whether you do it yourselves or a court makes the arrangements, you still have to work together. Separating assets, property, and custody rights is an emotional minefield. However, you can help ensure that you are prepared with the right tools. Use the Ultimate Divorce Checklist to help yourself stay on track and handle all the critical parts of the process. When you have the correct information and follow the necessary steps, it will ease some of the stress and help smooth the transition so you can focus on other things.